work from home equipment tax deduction

So instead of paying 20 of 50000 which would be 10000 the freelancer would pay 20 of 40000 which equals 8000. How much you can claim.

16 Amazing Tax Deductions For Independent Contractors Next

Over 350 premium deductions included.

. Yes thats a big question were hearing. Taking a Section 179 tax deduction is easy provided that all of the criteria to qualify for the deduction are met. Tax deductions for expenses needed to work from home are only available to taxpayers who itemize their deductions.

Purchase the equipment and put it into use during. Freelancers business owners and other self-employed workers have an easier time receiving work-from-home tax deductions. Before 2018 employees working from home could claim some unreimbursed expenses on their taxes.

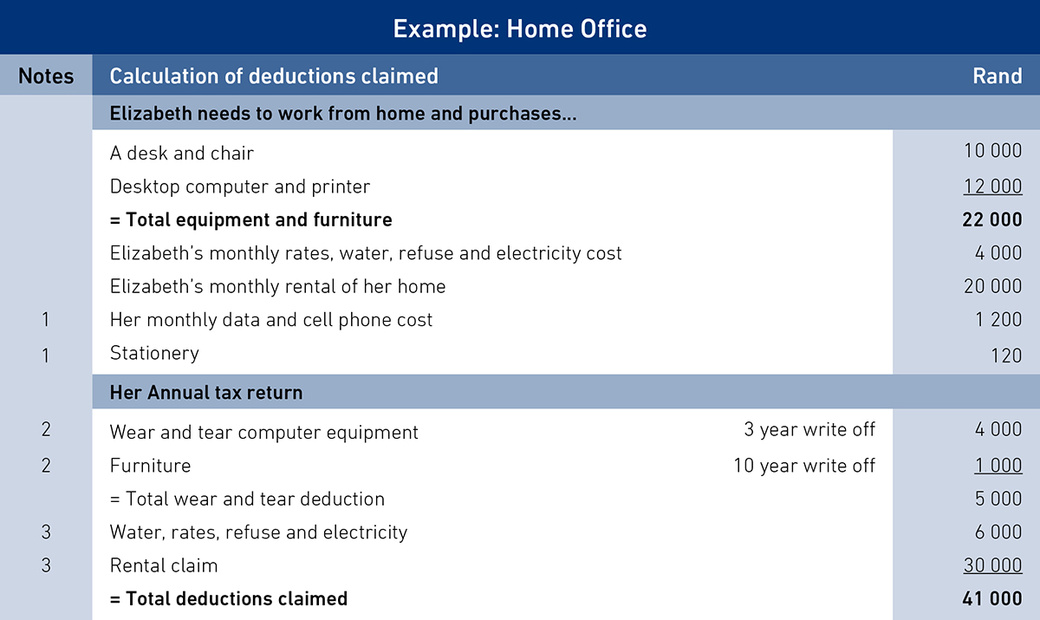

6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. If you are an employee who works from home and has set aside a room to be occupied for the purpose of trade you may be allowed to deduct certain expenses incurred in. When eligible to claim the home office deduction on your taxes you have two ways of claiming the deduction.

You must be a legal resident of. 455 Hoes Lane Piscataway NJ 08854 Phone. The home office deduction allows certain people who use part of their home for work to deduct some housing expenses.

Ad Browse Discover Thousands of Business Investing Book Titles for Less. You dont have to be a homeowner to claim the deduction apartments are eligible as are mobile homes boats or other similar properties according to the IRS. To take this deduction.

Keep records that show you incurred. To qualify you must be age 65 or older or a permanently and totally disabled individual or the unmarried surviving spouse age 55 or more of such person. The IRS used to allow W-2 employees to deduct expenses related to working from home but Congress changed that with its 2017 tax reform bill.

You cant claim it if youre a regular employee even if your company is requiring you to work from home due to COVID-19. Also work from home expenses can only be written. There are two methods for claiming the deduction.

Taxpayers who qualify may choose one of two methods to calculate their home office expense deduction. 6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you will not need to keep evidence of your extra. Learn More at AARP.

To claim a deduction for expenses you incur when working from home you need to. Ad Get the 2021 tax deductions free. If youre in this category you could deduct the.

The simplified option has a rate of 5 a square foot for business. So those 10000 in WFH expenses reduce. Guaranteed maximum tax refund.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. You can either claim tax relief on. The simplified method and the direct method.

And one thing to remember is now as a result of tax reform you can only claim home expenses if youre self. However the Tax Cuts and. Electricity expenses associated with heating cooling and lighting the area from.

The current deduction limit for the year 2022 is 1080000. A few very specific types of W-2. Claiming Work From Home on Your Taxes.

Use one of the methods set out below to calculate your deduction. What this basically means is that your company has the ability to make a deduction from the full cost of any. If you work from home you can claim a deduction for the additional running expenses you incur.

If youre employed by a company and you work from. Free tax filing for simple and complex returns.

Home Office Tax Deduction Prerequisites And Tips Ionos

A Guide To Working From Home In New Zealand Boundless

Working From Home Tax Deductions Covid

Employees Working From Home What Tax Deductions Can You Claim Mazars South Africa

How To Claim Your Work Related Car Expenses In 2020 Gofar

How Working From Home Affects Income Taxes Deductions 2021 2022

/personal-finance-work-from-home-guide_round1_grey-dfcbdfa007674b3bb6a568c8cf42b849.png)

The Ultimate Guide To Working From Home

10 Creative But Legal Tax Deductions Howstuffworks

![]()

Working From Home You May Qualify For Tax Deductions Pride Advice

Work From Home Tax Deductions You Can Claim This Year Abc Everyday

Home Office Deductions For Streamers Infographic

Top Ten 1099 Deductions Stride Blog

Tax Deductions For Workers 1 The New Daily

A Guide To Tax Deductions For Home Based Business

15 Self Employment Tax Deductions In 2022 Nerdwallet

Work From Home Deductions Expenses Can You Claim In 2022

Tax Deductions For Eas And Office Admins Capital Ea