how to calculate cash flow from balance sheet

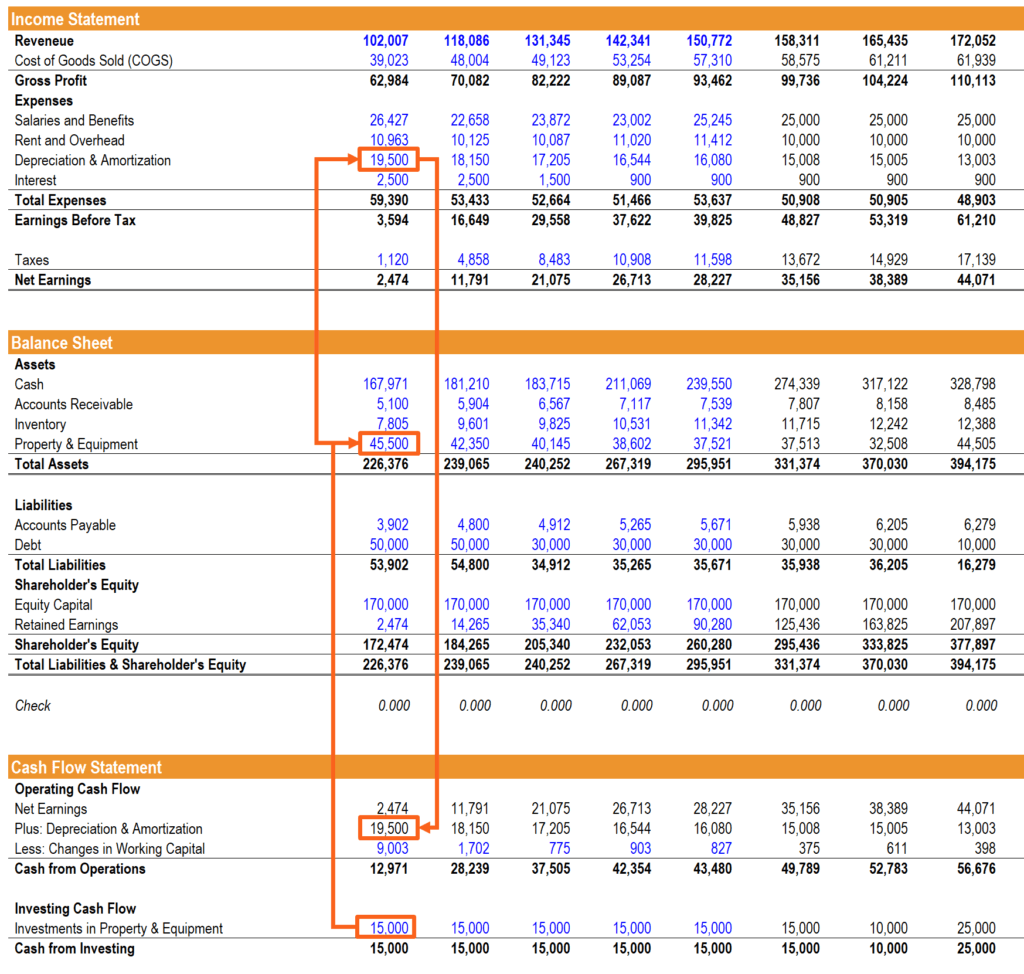

In this example subtract 125000 from 200000 to get 75000 in. Operating Cash Flow is calculated using the formula given below Operating Cash Flow Operating Income Depreciation Amortization Decrease in Working Capital Income Tax.

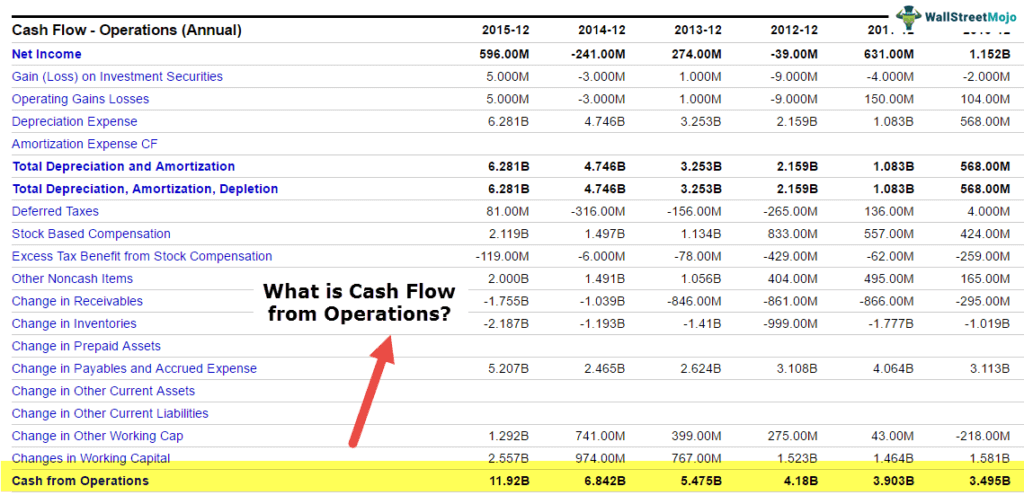

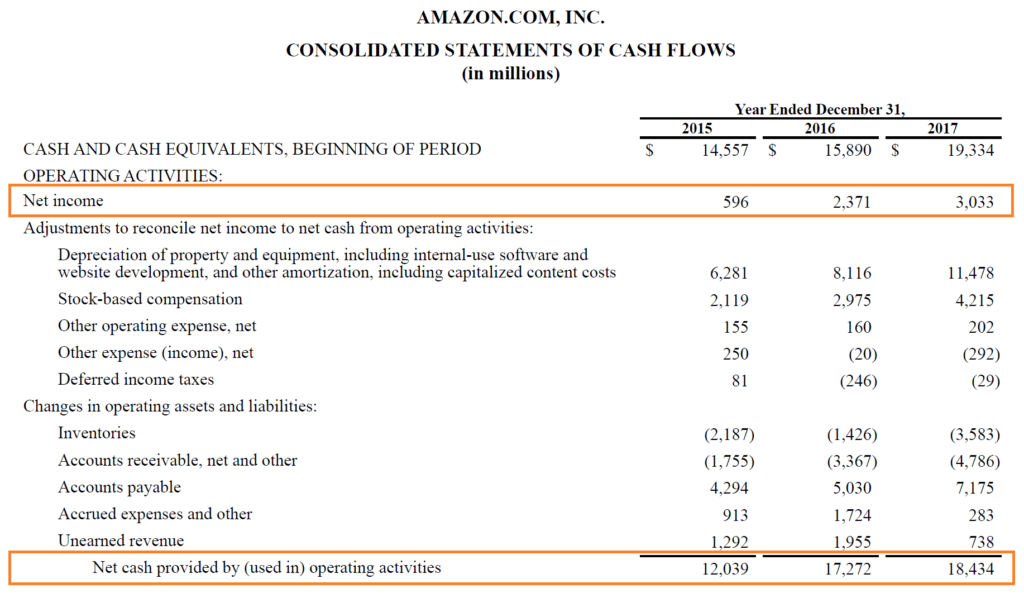

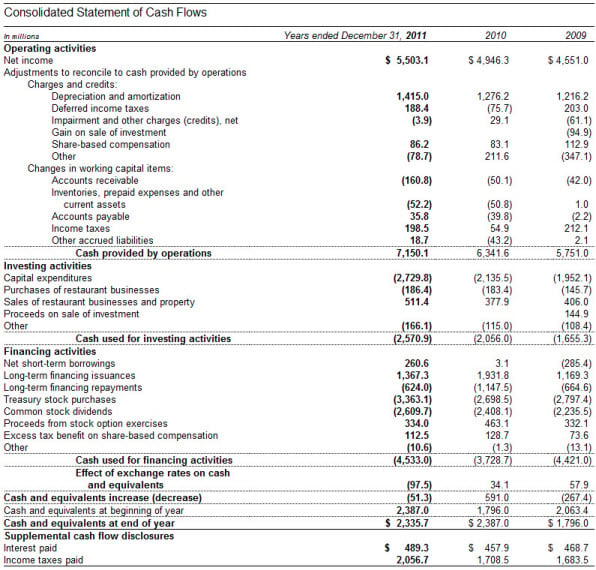

Cash Flow From Operations Formula Example How To Calculate

Operating cash flow Net income Non-cash expenses Increases in working capital.

. Operating Cash Flow Net income Depreciation and amortization Stock-based compensation Other operating expenses and income. Rated the 1 Accounting Solution. The following additional information is available Cash Receipt 650000 81000 65000 634000 Cash.

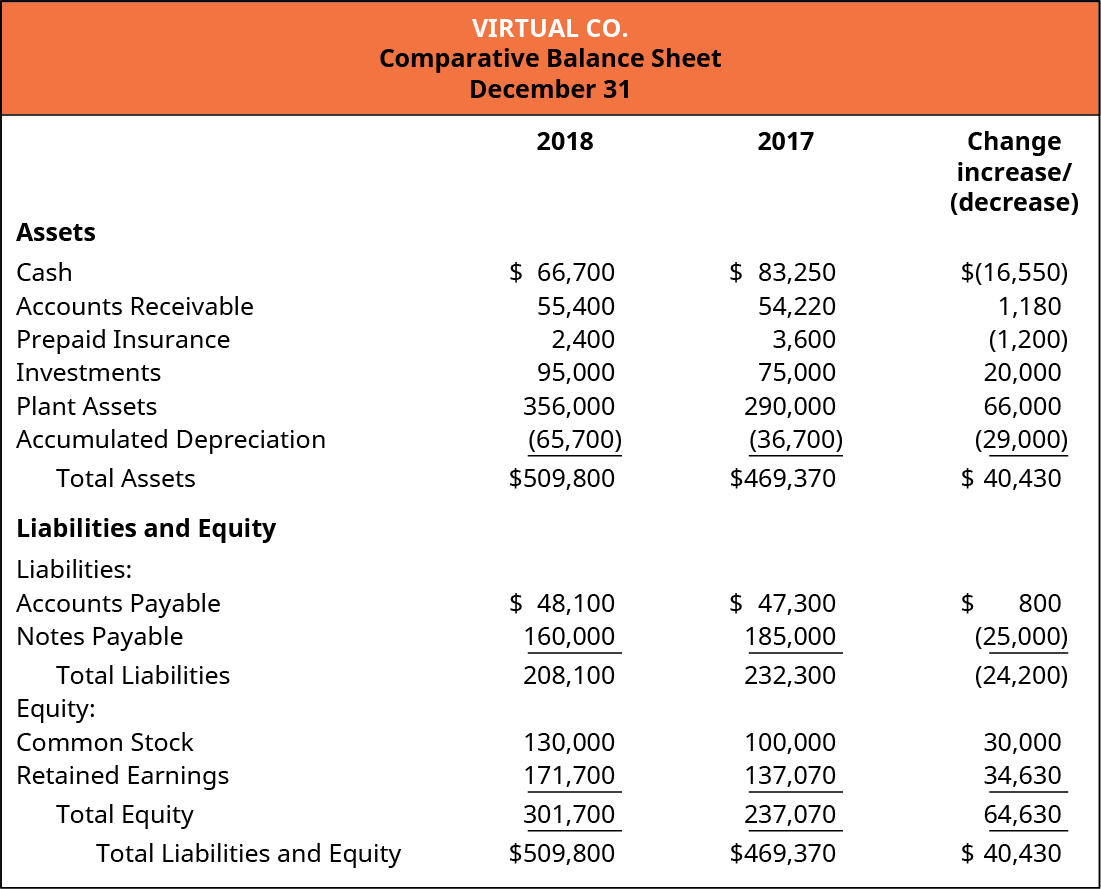

Cash Flow Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance. Cash flow from Investments formula Cash inflow from Sale of Land Cash outflow from PPE 30000 50000 -20000 CFI is an outflow of 20000 Cash Flow from Investing Activities. Subtract the amount of noncash current assets from total current assets to calculate the companys cash balance.

Operating Cash Flow Net Income -. Operating Cash Flow Formula. When calculating a statement of cash flow start by identifying the specific fiscal.

While the exact formula will be different for every company depending on the items they have on their income statement and balance sheet there is a generic cash flow from operations. A positive cash flow is good for the company as it determines financial success and a negative cash flow says otherwise. Cash on hand and demand deposits cash balance on.

Ad Learn how companies are getting the most value from working capital in uncertain times. How to calculate cash flow using the direct method 1. We can calculate the net cash flow from the statement of cash flows with the help of the following equation.

Net Operating Profit After Taxes Operating Income 1 - Tax Rate and where. Here are some examples of how to calculate cash flow from assets. Heres how this formula would work.

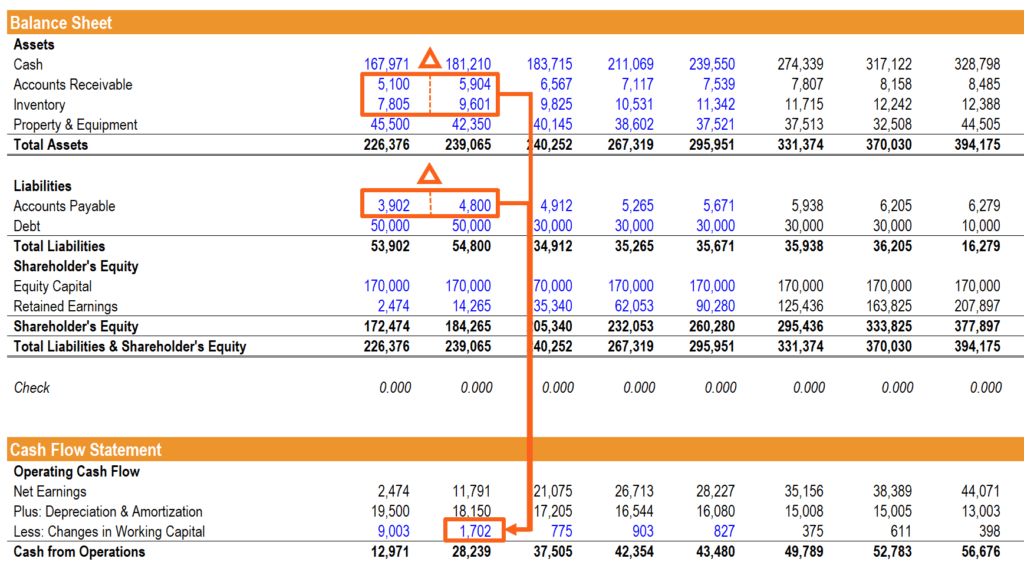

The balance sheet and cash flow statement are financial statements that companies issue to report their financial performance and are used by investors. Cash Flow From Operations. Learn the formula to calculate each and derive them from an income statement balance sheet or statement of cash flows Cash Balance.

Johnson Paper Company is a family company that. Operating Cash Flow Net Income Depreciation Stock Based Compensation Deferred Tax Other Non Cash Items Increase in Accounts Receivable Increase in Inventory Increase in. Get the most value from your working capital in uncertain times.

Important cash flow formulas to know about. You MUST show your steps in. Identify your fiscal period.

Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure Operating Cash. Ad QuickBooks Financial Software. Get the most value from your working capital in uncertain times.

The detailed operating cash flow formula is. To calculate your beginning cash balance for a cash flow statement add all of the sums of capital available to your business at the beginning of the period covered by the. Ad Learn how companies are getting the most value from working capital in uncertain times.

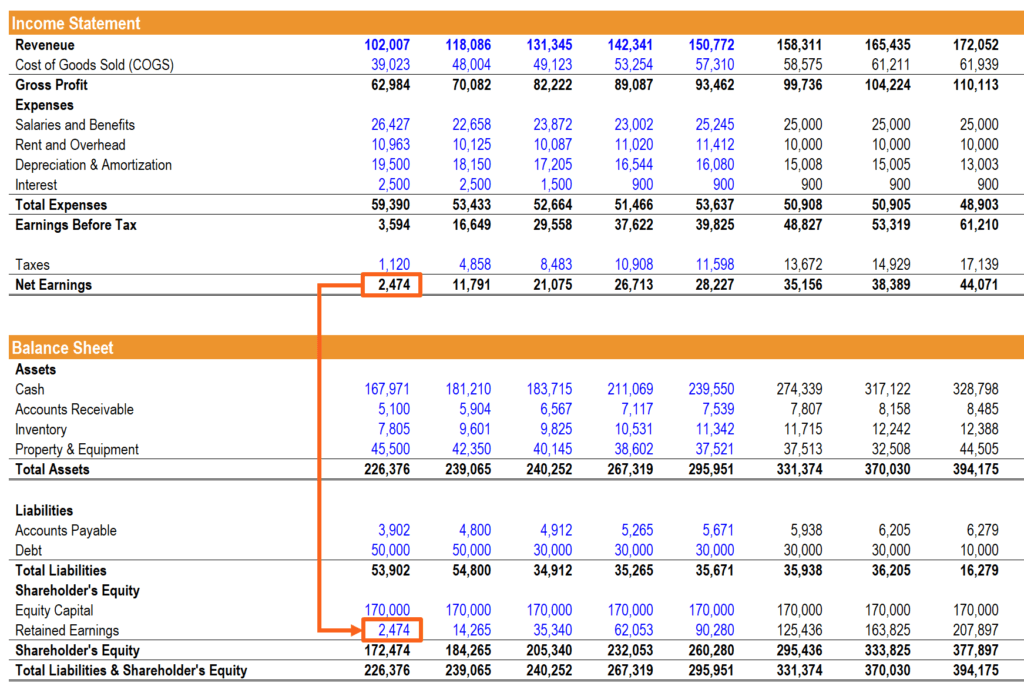

Calculate Cash Flow from Operations using the Direct Method. Use the following Balance Sheet and Income Statement to calculate your Cash Flow from Operations using the Indirect Method. Along with the income statement and balance sheet the statement of cash flows is one of the most important financial statements in accounting.

Therefore and as shown in. Your cash flow is determined by making specific changes to your net income by either adding or subtracting differences in your credit transactions expenses and revenue on the balance sheet. Cash Liabilities Equity - Other assets Change in Cash Change in Liabilities Change in Equity - Change in Other assets So the cash flow of the business can be determined.

The formula for calculating operating cash flow is as follows. Free Cash Flow Net Operating Profit After Taxes Net Investment in Operating Capital where. 2 Cash Flows From Operations The first section of the statement of.

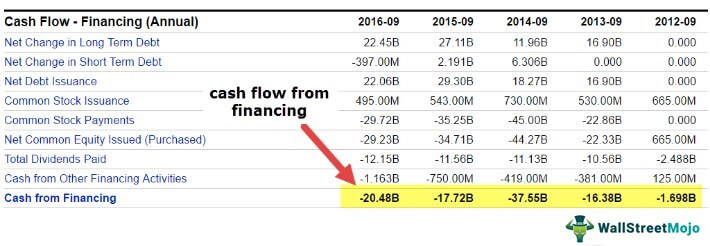

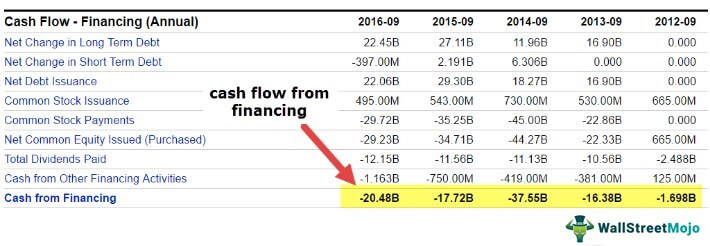

Example of calculating cash flow from assets. The proper format of the statement of cash flows is to divide the changes in cash flow into three sections. Cash Flow from Financing Activities Formula 10000 20000 7000 17000 Apple Example Now let us take an example of an organization and see how detailed cash flow from.

Rated the 1 Accounting Solution. Ad QuickBooks Financial Software. Net Cash Flow CFOCFICFF Cash from Operating Activities CFO.

Balance Sheet Vs Cash Flow Statement Accounting Education

Three Statement Model Links A Simple Model

Financial Statements Understanding Cash Flow Statement Of A Company Getmoneyrich

How The 3 Financial Statements Are Linked Together Step By Step

Cash Flow From Financing Activities Formula Calculations

Operating Cash Flow Definition Formula And Examples

Prepare The Completed Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Operating Cash Flow Formula Calculation With Examples

Cash Flow Report Process Street

How To Prepare A Cash Flow Statement Hbs Online

Training Modular Financial Modeling Annual Forecast Model Financial Statements Cash Flow Statement Modano

Net Cash Flow How To Calculate Vs Net Income Importance Analysis

How Do Net Income And Operating Cash Flow Differ

What Is A Cash Flow Statement What Are The Three Sections Wikiaccounting

Cash Flow Statement Definition Example And Complete Guide Fourweekmba

How The 3 Financial Statements Are Linked Together Step By Step

How The 3 Financial Statements Are Linked Together Step By Step

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)